International Monetary Fund

Advisor to Executive Director

Edge Capital is a leading venture and market-neutral fund that manages more than $500m of assets for crypto fund of funds, institutional investors as well as largest crypto foundations and treasuries since 2020

Generating venture-style returns by applying multi-strategy approach designed to capture value across CeFi & DeFi

Targeting 3+ Sharpe, limited drawdowns, uncorrelated to digital assets

Audited and regulated track record, 3.5+ Sharpe since 2020, 0.01 correlation to BTC.

The fund has the ability to generate returns in crypto-denominated share classes while keeping full directional risk on BTC, ETH, SOL, AVAX, and INJ

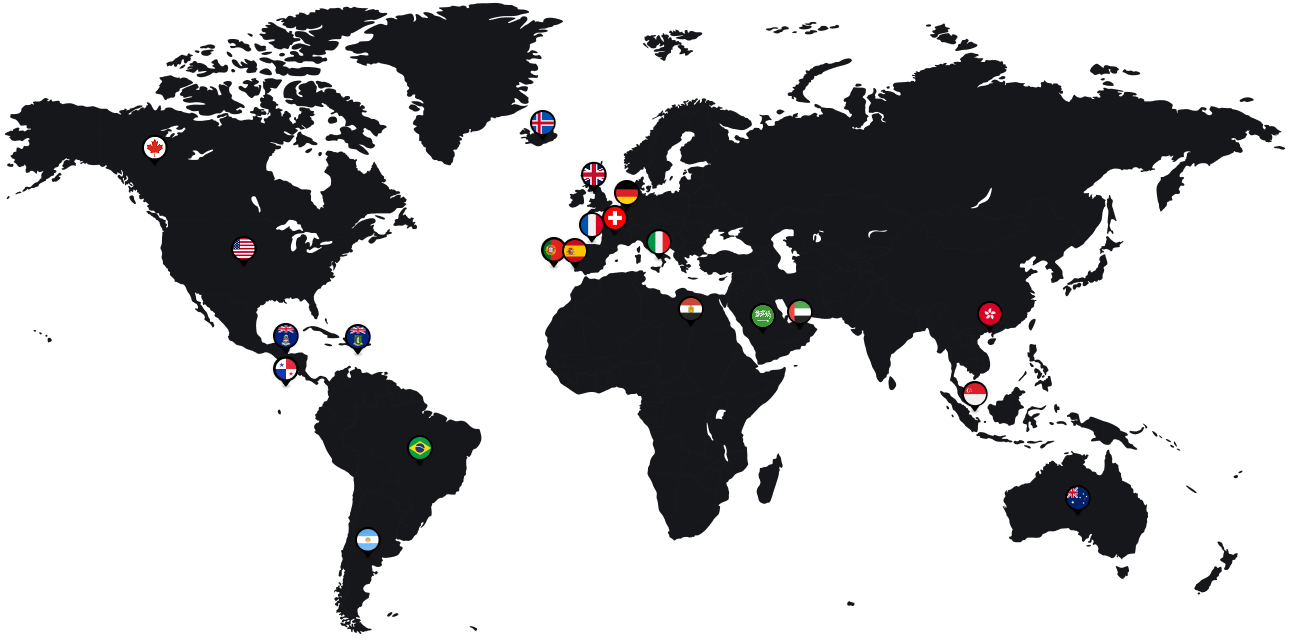

The fund is registered as mutual fund in the Cayman Islands and the management company is regulated in multiple jurisdictions

Net Returns for Various Share Classes*

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| '20 | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.4% | 3.7% | 2.0% | 0.1% | 2.4% | 11.2% |

| '21 | 1.4% | 0.8% | 4.9% | 5.6% | 1.5% | 1.3% | 1.6% | 2.8% | 2.3% | 1.5% | 1.0% | 0.6% | 28.1% |

| '22 | 1.3% | 1.2% | 1.6% | 0.6% | 5.2% | -1.4% | 0.4% | 0.1% | 0.2% | 0.7% | -2.4% | 0.0% | 7.6% |

| '23 | 0.9% | 0.9% | 4.6% | 0.7% | 0.2% | 0.3% | 0.5% | 0.2% | 0.0% | -0.2% | 1.0% | 2.6% | 12.2% |

| '24 | 1.7% | 1.6% | 3.6% | 3.7% | 1.9% | 3.9% | 2.5% | 1.7% | 2.3% | 0.7% | 2.1% | 1.2% | 30.3% |

| '25 | 1.5% | 0.8% | 0.9% | 0.7% | 1.4% | 1.4% | 1.0% | 1.0% | 0.0% | 0.0% | 0.0% | 0.0% | 9.1% |

| Year | '20 | '21 | '22 | '23 | '24 | '25 |

|---|---|---|---|---|---|---|

| Jan | 0.0% | 1.4% | 1.3% | 0.9% | 1.7% | 1.5% |

| Feb | 0.0% | 0.8% | 1.2% | 0.9% | 1.6% | 0.8% |

| Mar | 0.0% | 4.9% | 1.6% | 4.6% | 3.6% | 0.9% |

| Apr | 0.0% | 5.6% | 0.6% | 0.7% | 3.7% | 0.7% |

| May | 0.0% | 1.5% | 5.2% | 0.2% | 1.9% | 1.4% |

| Jun | 0.0% | 1.3% | -1.4% | 0.3% | 3.9% | 1.4% |

| Jul | 0.0% | 1.6% | 0.4% | 0.5% | 2.5% | 1.0% |

| Aug | 2.4% | 2.8% | 0.1% | 0.2% | 1.7% | 1.0% |

| Sep | 3.7% | 2.3% | 0.2% | 0.0% | 2.3% | 0.0% |

| Oct | 2.0% | 1.5% | 0.7% | -0.2% | 0.7% | 0.0% |

| Nov | 0.1% | 1.0% | -2.4% | 1.0% | 2.1% | 0.0% |

| Dec | 2.4% | 0.6% | 0.0% | 2.6% | 1.2% | 0.0% |

| YTD | 11.2% | 28.1% | 7.6% | 12.2% | 30.3% | 9.1% |

Generate yield on top of your tokens

Yield on top BTC holding, with preserving full directional risk on BTC

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| '20 | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.5% | 3.0% | 2.0% | 0.1% | 1.9% | 9.8% |

| '21 | 1.0% | 0.5% | 4.3% | 4.1% | 1.2% | 1.3% | 2.5% | 2.9% | 1.9% | 1.3% | 1.1% | 0.4% | 24.8% |

| '22 | 1.6% | 1.1% | 1.5% | 0.7% | 6.2% | -2.2% | 0.3% | 0.1% | 0.2% | 0.7% | -2.9% | 0.0% | 5.6% |

| '23 | 0.6% | 0.9% | 3.8% | 0.7% | 0.2% | 0.3% | 0.5% | 0.2% | 0.0% | -0.2% | 1.0% | 2.2% | 10.6% |

| '24 | 1.6% | 1.0% | 3.3% | 4.1% | 1.6% | 4.5% | 2.3% | 2.2% | 1.9% | 0.5% | 1.3% | 1.4% | 29.1% |

| '25 | 1.2% | 1.3% | 0.9% | 0.3% | 1.0% | 1.4% | 0.8% | 1.2% | 0.0% | 0.0% | 0.0% | 0.0% | 8.3% |

| Year | '20 | '21 | '22 | '23 | '24 | '25 |

|---|---|---|---|---|---|---|

| Jan | 0.0% | 1.0% | 1.6% | 0.6% | 1.6% | 1.2% |

| Feb | 0.0% | 0.5% | 1.1% | 0.9% | 1.0% | 1.3% |

| Mar | 0.0% | 4.3% | 1.5% | 3.8% | 3.3% | 0.9% |

| Apr | 0.0% | 4.1% | 0.7% | 0.7% | 4.1% | 0.3% |

| May | 0.0% | 1.2% | 6.2% | 0.2% | 1.6% | 1.0% |

| Jun | 0.0% | 1.3% | -2.2% | 0.3% | 4.5% | 1.4% |

| Jul | 0.0% | 2.5% | 0.3% | 0.5% | 2.3% | 0.8% |

| Aug | 2.5% | 2.9% | 0.1% | 0.2% | 2.2% | 1.2% |

| Sep | 3.0% | 1.9% | 0.2% | 0.0% | 1.9% | 0.0% |

| Oct | 2.0% | 1.3% | 0.7% | -0.2% | 0.5% | 0.0% |

| Nov | 0.1% | 1.1% | -2.9% | 1.0% | 1.3% | 0.0% |

| Dec | 1.9% | 0.4% | 0.0% | 2.2% | 1.4% | 0.0% |

| YTD | 9.8% | 24.8% | 5.6% | 10.6% | 29.1% | 8.3% |

Experts in DeFi smart contracts and digital assets since 2020

Generating USD and crypto-denominated returns in BTC, ETH, SOL, USDT & more token share classes

Current investors and trusted partners are leading crypto foundations, banks, FoFs and ETF providers.

Legal structuring, strict risk limits on drawdowns, largest insurance purchaser against hacks.

Recognized as experts within the DeFi ecosystem, sought after by leading protocols and institutions.

As part of our market-neutral strategy, we are one of the largest players in providing liquidity (TVL) to early-stage protocols

seeking TVL to boost growth

for emerging projects

leading institutions

150+ protocols staked, 10k transactions

$1bn+

Non-directional, Multi-Strategy approach covering the entire spectrum of CeFi and DeFi trading opportunities.

At the core of the strategy

Founder, Chief Investment Officer

Advisor to Executive Director

Director for FI/FX Strategy

Investment Team (AuM at ~$2bn in 2018)

Founder and CIO

Worked with the FBI on high profile smart contract hack cases.

Secured largest insurance claim in blockchain history.

Genesis Restructuring Committee

Engineered first tri-party agreement for off-exchange custody with leading banks.

Advisor to Executive Director

Director for FI/FX Strategy

Investment Team (AuM at ~$2bn in 2018)

Founder and CIO

Head of Research

Business Development

Edge Ventures Managing Partner

IR Associate

Head of Operations

Head of Research

Business Development

Edge Ventures Managing Partner

IR Associate

Head of Operations

Access to this website is restricted to professional or accredited investors only. This includes (i) persons who are not located in the United States or the European Union, qualify as accredited investors under the laws of their country of residence, and are not subject to any legal or regulatory restrictions on accessing financial or analytical materials; and (ii) persons who are accredited investors under the U.S. Securities Act of 1933 or professional or qualified investors under the applicable laws and regulations of a European Union member state. By proceeding, you confirm that you meet the criteria described above and are permitted to access the information contained herein under the laws and regulations of your jurisdiction...